Case Study/ CyberSecurity

Simplifying Compliance DashMagiq® Automates DLP Policy Governance in Banking Sector

100%

Tracking and Monitoring of Policy Edits

Zero

Technical Expertise Needed

80 Hours

Saved Per Month in Policy Interventions

Streamlined Policy Updates: By automating the workflow, policy updates that used to take days could now be completed within hours, improving operational efficiency.

Zero Manual Intervention: The integration of RPA into the workflow allowed for automatic policy execution on the DLP console, saving over 80 hours of manual labour per month.

Real-Time Monitoring and Alerts: DashMagiq’s monitoring capabilities drastically reduced the occurrence of unauthorized policy edits, providing better oversight and security.

A major financial institution urgently required an efficient method for multiple business groups to review and suggest updates to its DLP policies. The traditional process left gaps in policy review transparency and created bottlenecks in implementing policy updates across departments. Moreover, ensuring the edits were approved, tracked, and executed without breaching compliance standards proved challenging. Manual interventions for policy edits were error-prone, time-consuming, and exposed the institution to potential compliance risks with their central bank's stringent regulations. The bank sought a solution that would automate these processes while allowing input from key business leaders and maintaining strict regulatory compliance.

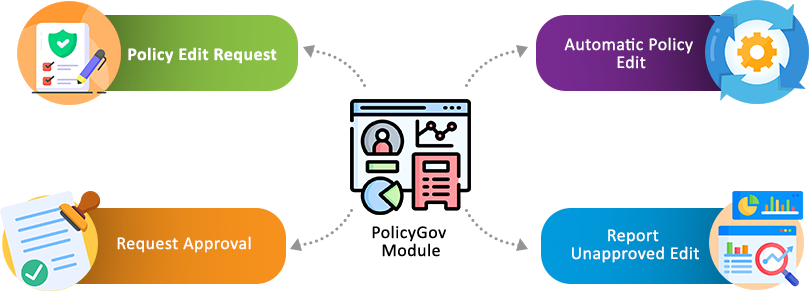

Vidyatech implemented DashMagiq® Policy Governance Workflow, an innovative Maker-Checker system that automates the entire DLP policy review and update process. The Workflow empowered business groups to suggest edits to DLP policies using intuitive, customizable questionnaires, which simplified the interaction between business units and the InfoSec team. Once an edit is submitted, the system automatically notifies the policy owner via email for approval.

The workflow automatically forwarded these policy suggestions to the designated approvers. Upon approval, DashMagiq’s RPA bots instantly implemented the approved changes on the DLP console, minimizing the need for human involvement. The system also monitored the DLP console for unapproved edits, triggering alerts for unauthorized actions that required investigation. The entire process is tracked and stored, providing a robust audit trail that ensures compliance with the regulatory requirements imposed by the central bank. The system is highly flexible and integrates seamlessly with any DLP solution, giving the institution the confidence to manage its DLP policies more efficiently and securely.

The deployment of DashMagiq® DLP Workflow delivered significant operational improvements for the bank:

Reduced risk of non-compliance: The automated audit trail ensured that every policy update was properly logged and could be verified during regulatory audits, reducing compliance risks by 40%.

Enhanced Compliance: By automatically generating and maintaining audit trails, the institution was able to meet all regulatory requirements without additional overhead.

Proactive Alerts: DashMagiq®'s real-time alert system significantly reduced unauthorized policy changes, mitigating potential compliance violations.

Customizable and Scalable: The system’s flexibility in tailoring questionnaires and email templates allowed the bank to adapt the solution to its evolving needs as regulations and business priorities changed.

DashMagiq® Policy Governance Workflow

Your DLP Implementation is incomplete without DashMagiq® Policy Governance Workflow. DashMagiq® Policy Governance Workflow enables business leaders and InfoSec team to collaboratively finetune policies that impact business processes adversely. The business leaders review and recommend edits to DLP policies using simple questionnaires presented by DashMagiq®. All interactions between the business leaders and the InfoSec team are tracked and stored for compliance purposes.

Learn More